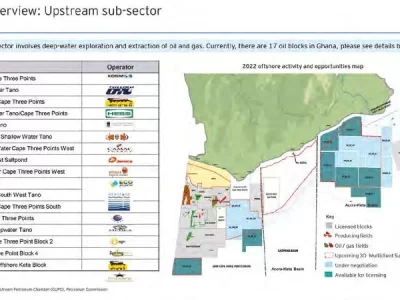

Ghana boasts a dynamic financial sector, which has grown a lot since 2010, with more Ghanaians gaining access to formal financial services. The sector is dominated by the banking sector, although insurance, pension and capital markets have emerged in recent years. Starting in 2010, the discovery and exploration of oil o Ghana’s shores opened new horizons for the financial sector, which developed specific products for the new-born oil industry.

Strengthening the banking system

Ghana had 62 Non-Bank Financial Institutions (NBFIs), 144 Rural and Community Banks (RCBs) and 419 Forex Bureaus at the end of 2018. The number of Deposit Money Banks (DMBs) went down to 23 in January 2019, when the Bank of Ghana closed down Premium Bank and Heritage Bank.

Effective in December 2018, Ghana increased the minimum capital required from banks to GHC400 million (US$83 million), up from GHC120 million, to strengthen the banking system. Authorities reinforced supervision through a series of directives improving corporate governance and risk management. These measures were prompted by the collapse of two banks that revealed the vulnerability of the sector. All of the existing 23 banks meet the minimum capital requirement of GHC400 million for deposit-taking financial institutions. Fresh capital of GHC4.2 billion was injected into the banks. The capital requirement for non-bank financial institutions was set at GHC15 million in January 2019.

Between August 2017 and December 2018, Ghana closed nine domestically- owned universal banks. The assets and liabilities of two were transferred to a state owned universal bank while those of the remaining seven were moved to a bridge bank (Consolidated Bank Ghana (CBG)).

The CBG was capitalised by the government of Ghana to the sum of about $100 million (0.2% of GDP). The government also issued a domestic bond equivalent to $1.65 billion (2.5% of GDP) to cover the gap between the liabilities and the good assets assumed by the CBG.

The Bank of Ghana (BoG) identified specialised deposit-taking institutions (SDIs) as particularly vulnerable as numerous licences had been distributed over the years, often without the requireddue diligence. It revoked 386 licences in May 2019 as part of its SDI resolution and recovery plans, closing down micro finance institutions, rural and community banks, susu collectors, savings and loans firms and finance houses. With many SDIs facing liquidity issues, the BoG estimated in 2017 that over 700,000 depositors were at risk.

Building a more financially inclusive economy

Banks have recently contributed the least to increasing financial inclusion across the country, according to the World Bank. Much of this is the result of their lack of focus on offering financial solutions to everyday Ghanaians, but instead focusing on corporate banking and high net worth individuals. However, the growth of mobile money has demonstrated the potential of retail financial services.

In 2017, 58% of Ghana’s population had a registered financial account while 39% had mobile money accounts. Transactions at ATMs and POS terminals have registered consistent growth, reaching 2.3 million in 2017. The number of direct credit transactions is growing too.

Mobile phone penetration has created opportunities for the expansion of financial services and increased the role of non-financial institutions as much as e-money issuers, positioning Ghana as the fastest growing mobile money market in Africa, according to the World Bank’s 4th Ghana Economic Update. This dynamic development indicates the potential of digital financial services and payments to further enhance financial inclusion in Ghana. The number of active agents increased from around 6,000 in 2012 to more than 150,000in 2017. The government has facilitated interoperability across payment instruments by establishing a mobile money switching solution. In May 2018, the Ghana Interbank Payment Settlement System (GhIPSS) went live with one of the first interoperable mobile money switches in Africa.

In 2018, the government introduced the E-zwich biometric card, used at ATMs or banks as well as for payments, including salaries and pensions.

GOVERNMENT POLICY INCLUDES A 3-YEAR ROADMAP TO STRENGTHEN THE DIGITAL FINANCIAL SERVICES ECOSYSTEM.

Insurance sector developments

The National Insurance Commission has announced new minimum capital requirements for the insurance industry to address the challenge of low capitalisation. The new minimum requirement are as follows:

• Life and Non-Life Insurers: from GHC15 million to GHC50 million.

• Brokers and Loss Adjusters: from GHC300,000 to GHC500,000.

• Reinsurance Brokers: maintained at GHC1 million.

• Reinsurance: from GHC40 million to GHC125 million.

The new minimum capital will apply immediately to newly licensed companies and existing insurers will have until June 2021 to meet the new capital requirement.

Securities market

There are 42 companies listed on the Ghana Stock Exchange (GSE) and 21 stockbrokers. As of October 2019, the GSE’s market capitalisation was GHC55.64 billion.

Investment opportunities

There is a high demand for various financial services in Ghana, as evidenced by the consistent high growth of companies in the sector. The relatively underdeveloped financial services sector in neighbouring countries is an opportunity for financial service firms in Ghana to supply needed services in those countries.

Institutions can acquire licences to operate credit reference bureaus in Ghana.

General investment opportunities exist for universal, development and investment banks and for companies in the following areas: insurance, reinsurance, leasing, venture capital, saving and loans, export finance, hire purchase, mortgage finance institutions, mutual funds, investment trusts and specialised finance houses.

Comments