Ghanaian cities’ rapidly changing landscapes are a testimony to the aggressive growth of the construction and real estate sector. Over half of Ghana’s population lives in urban areas with its two major cities, Accra and Kumasi, accommodating a rapidly increasing population of 2.2 and 1.4 million respectively.

With a vibrant middle-income economy, an increasing young population, a sophisticated and well-educated professional class, the rising demand for all types of property development largely outstrips local supply.

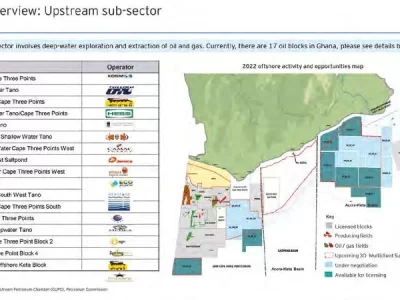

The property development sector has consistently registered double-digit growth in the past 5 years, bolstered by investments in real estate and construction, mining, oil & gas and improved public infrastructure. The construction sector contributed about GHC19 billion to GDP, or 6.3%, in 2018, according to the Ghana Statistical Service.

Until recently, this sector was considered a greenfield in terms of regulation and policy framework. However, with its growing significance and contribution to the country’s economy, the government is taking a keener interest in ensuring smoother operations and fair participation.

Residential properties

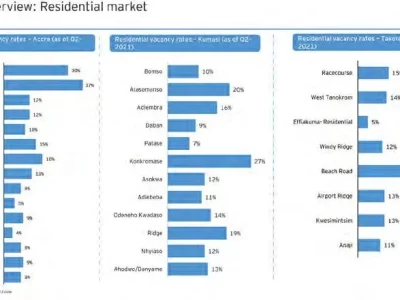

Ghana’s current housing deficit is estimated at about 1.7 million units, with an annual demand of 100,000 units to meet a rapidly increasing population growth rate. Though major real-estate companies continue to produce and sell housing units to individuals and families, there is still serious demand for more housing options, from affordable to high-end.

Demand for upmarket residential development in Accra is strong. In recent years, developers have focused mainly on high-end buyers to ensure return on their investments and to take advantage of the significant demand from expatriates working in Ghana. Ghanaian individuals build houses to be rented out or sold for high profits.

The rental market in Accra is relatively large with 37.5% of all households renting, compared to 22% for Ghana as a whole. Only 40.4% of households in Accra claim ownership of their houses, against 57.4% for Ghana.

Ghana’s main housing challenge is now to build houses for low-income earners. Financing options for middle-to-low income individuals are minimal. The local mortgage market is limited while the cost of long-term financing is high and unattractive.

Acknowledging the need to meet the United Nations’ Sustainable Development Goals, the government of Ghana has prioritised provision of and access to decent and affordable housing through budgetary allocations, specific policies and fiscal provisions, as well as development partnerships over the past few years.

Commercial properties

The positive outlook for Ghana’s economy and the increased participation of multinational companies and expatriate workers has boosted the property sector. Demand for luxury hotel facilities and services has led to the entry of major hotel management brands into Ghana.

Since then, the construction of hotels, retail centres and malls, business centres, office and mixed-use facilities has experienced rapid growth. Burgeoning financial, oil and gas, education and technology sectors have been responsible for spikes in housing demand over the past five years.

There is also increasing demand for office space for entrepreneurs, start-up companies and investing multinational companies starting local operations in Ghana. Warehousing has become a hot commodity with more and bigger manufacturing set-ups establishing West African operations in Ghana.

The retail property sector is booming with high-end shopping malls sprouting up in city centres. There are 12 major shopping malls in Ghana. The first one, Accra Mall, opened in 2007. Six new malls appeared in Accra alone between 2013 and 2018.

Kumasi Mall, which cost US$370 million, opened in 2017. Takoradi is expected to have a new mall in the next three years.

THE CONSTRUCTION OF HOTELS, RETAIL CENTRES AND MALLS, BUSINESS CENTRES, OFFICE AND MIXED-USE FACILITIES HAS EXPERIENCED RAPID GROWTH.

Public/ social infrastructure

Property development and construction companies have, in recent years, broken into the large technical and infrastructural projects taking place across major sectors, from public housing units to roads, bridges, tank farms, school facilities, industrial warehousing, telecommunication apparatus, and energy and mining construction. As most of these companies exhibit professionalism and competence in such projects, most government institutions and agencies, large multinationals and local development agencies have found it cost-effective and prudent to contract such companies to execute small-to-large projects with size able budgets.

The sector faces several challenges, such as sky-rocketing costs for prime lands and housing in cities; high inflation; legal issues with land acquisition and ownership; and lack of financing options for low-income families.

In a bid to ease access to long-term and low-cost financing for the real estate sector, Ghana launched the Construction Bank in 2017. This is a wholly Ghanaian-owned company that will provide banking services in project finance, commercial and consumer banking and specialise in construction, infrastructure and mortgage financing.

Investment opportunities

The government encourages private sector investment and the Ghana Investment Promotion Centre (GIPC) points to the following opportunities:

- The huge housing deficit provides opportunities to build low-cost housing units for low-income families.

- Innovative building technologies could be introduced into slums and densely populated areas to reduce pressure on urban housing.

- The mortgage market could be developed to accommodate low-cost housing schemes and projects.

- The rapidly growing middle-class provides a ready market for moderately priced housing.

Comments