Ghana discovered oil in commercial quantities in 2007 and started production in 2010. Since then, the oil and gas sector has become an important source of foreign investment, revenue and growth for the country. Production is concentrated in the three fields off the country’s western coast – the Jubilee, Tweneboa Enyenra Ntomme (TEN), and Sankofa-Gye Nyame. The three fields had a combined output of 55.06 million barrels of oil, 18,632 mscf of gas and $783 million in revenue in 2021. According to the Ghana Revenue Authority, the sector was responsible for 6.5 per cent of total government revenue in the 2020 fiscal year.

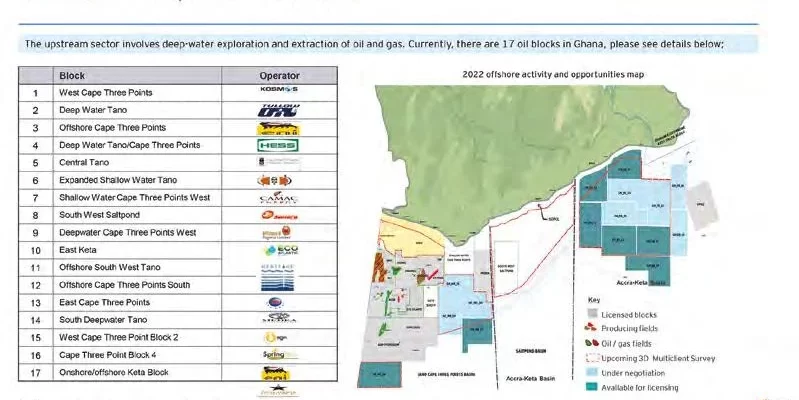

There are 16 operators in the upstream sector, which involves deep-water exploration and extraction of oil and gas. There are 17 oil blocks with 179 active oil wells in the country. Ghana’s midstream industry is still in the developing stage. The country’s sole oil refinery, Tema Oil Refinery, has an operational capacity of 45,000 barrels per day (bpd). However, operational challenges have since reduced its capacity to 24,000 bpd on average. The country thus has to rely on refined fuel imports from countries such as Italy, Netherlands, and the United Arab Emirates to complement supplies from other producers in the region. The downstream industry activities consist of the distribution and marketing of petroleum products by bulk distribution companies (BDCs) and oil marketing companies (OMCs), as well as pre-mixing of petroleum products for other industrial uses. There are 170 oil marketing companies, 42 liquefied petroleum gas marketing companies and 37 bulk distribution companies operating in the sector.

In 2021, 25 new discoveries were announced, which indicates that the sector still has tremendous potential for growth. In July 2021, ENI, one of the upstream players, announced that it had made a significant oil discovery on the Ebanprospect in Cape Three Points Block 4. The company estimates the potential of the Eban–Akoma complex to be between 500 and 700 Mboe. Ghana’s Petroleum Commission approved a 10-month programme to acquire 14,000 sq km of 3D seismic data over Ghana’s offshore Keta Basin in December 2022 and in January 2022 the Ghana National Petroleum Corporation commenced a 2D seismic survey in the Volta Basin to gather information on the area.

Oil from the country’s fields is light and sweet and assessments have shown it to have an API gravity of 37.6 degrees and a sulphur content of 0.25 per cent (weight), with no unusual characteristics – it is the type of oil that is attractive for worldwide refineries and can compete with the international price reference oils. The government of Ghana is making efforts to facilitate a petroleum hub in the country with end-end exploitation of its oil and gas resources.

Parliament passed a bill in October 2022 to establish a Petroleum Hub Development Corporation that will be the main vehicle for the achievement of its strategic vision. The hub is expected to comprise four refineries, two oil jetties, crude oil storage tanks and two petrochemical plants.

84 to ensure upstream petroleum activities are executed in a safe and efficient manner and that Ghana derives optimal benefit from the exploitation of petroleum resources. The Petroleum Commission is the agency that oversees the sub-sector. The downstream industry is regulated by the National Petroleum Authority. This authority was established by an act of parliament; NPA Act 2005, Act 691 to ensure efficient, profitable fair industry operations while ensuring value for money for consumers.

The Ghana National Petroleum Corporation leads the sustainable exploration, development, production and disposal of the petroleum resources of Ghana, by leveraging the right mix of domestic and foreign investments. The Ministry of Energy is responsible for creating, implementing, monitoring and assessing policies in the sector.

Sector Opportunities

• Investment in an independent power plant to serve the sector and boost productivity

• Partnership with the government and the Petroleum Development Hub Corporation to invest in infrastructure for processing crude oil and raw natural gas into petroleum products to trade, store, transport and to distribute

• Provision of refinery, storage, marketing and transportation of petroleum and gas products

• Investment in the midstream sector to boost refinery capacity to reduce import dependency

• Opportunity for the introduction of 4D seismic technology that will provide more reliable data on changes in reservoirs

• Investment in natural gas infrastructure to support the Tema LNG terminal currently under construction in the country, the first such project, in sub-Saharan Africa

• Provision of drilling products and services ■TG

The government of Ghana offers several incentives to investors in the country’s oil and gas sector. These include double taxation agreements, guarantees against expropriation, corporate tax exemptions and waivers on import duties and levies on machinery and equipment. Other incentives are the ability to carry losses forward for up to for three years, bilateral investment treaties and membership of the Multilateral Investment Guarantee Agency.

The oil and gas industry in Ghana is supported by indigenous companies that specialise in the provision of offshore and onshore services to international oil companies. However, since most indigenous Ghanaian companies do not have the ability to provide these specialised services, foreign companies with the capacity are able to partner with local ones to deliver these services.

Ghana has a robust regulatory framework and favourable government policies that are designed to create an enabling environment for increased participation and investment in the sector. The upstream sector is regulated by the Petroleum (Exploration and Production) Act, 2016 (Act 919), which was introduced to replace the Provisional National Defence Council Law (PNDCL)

84 to ensure upstream petroleum activities are executed in a safe and efficient manner and that Ghana derives optimal benefit from the exploitation of petroleum resources. The Petroleum Commission is the agency that oversees the sub-sector. The downstream industry is regulated by the National Petroleum Authority. This authority was established by an act of parliament; NPA Act 2005, Act 691 to ensure efficient, profitable fair industry operations while ensuring value for money for consumers.

The Ghana National Petroleum Corporation leads the sustainable exploration, development, production and disposal of the petroleum resources of Ghana, by leveraging the right mix of domestic

and foreign investments. The Ministry of Energy is responsible for creating, implementing, monitoring and assessing policies in the sector.

SECTOR OPPORTUNITIES

• Investment in an independent power plant to serve the sector and boost productivity

• Partnership with the government and the Petroleum Development Hub Corporation to invest in infrastructure for processing crude oil and raw natural gas into petroleum products to trade, store, transport and to distribute

• Provision of refinery, storage, marketing and transportation of petroleum and gas products

• Investment in the midstream sector to boost refinery capacity to reduce import dependency

• Opportunity for the introduction of 4D seismic technology that will provide more reliable data on changes in reservoirs

• Investment in natural gas infrastructure to support the Tema LNG terminal currently under construction in the country, the first such project, in sub-Saharan Africa

• Provision of drilling products and services ■TG

Comments