Top Guide: How did you come to set up N. Dowuona & Company and what were you doing prior to that?

Nana Ama Botchway: Around 2010, having worked in private equity for a few years, I decided to return to private practice. Having retained and worked with firms of all sizes in my capacity as chief operating officer of one of the first pan-African private equity funds, I had gained some useful insights into what international institutional clients are looking for from their African counsel. Having attended two Ivy Leagues and started my career at firms like Deloitte and Simpson Thacher & Bartlett in New York before returning to Ghana, I also knew what Africa’s best and brightest professionals, keen to build a rewarding and impactful career in Ghana doing world class work, would want. So, I decided to set up the N. Dowuona & Company to respond to those needs. That’s how my own journey as an investor in Ghana began.

Thirteen years later the firm has a leadership team that has over 60 years of combined experience in law and business and a team of the best and brightest minds in Ghana. We have been internationally ranked as one of the elite leading firms in the leading law firm directories such as Chambers and Partners and Legal 500. We have won numerous international awards including Ghana Law Firm of the Year 2023 at the Chambers Africa Awards. We have also been shortlisted as West African Law firm of the year by the Africa Legal Awards this year. Our team and alumni, include graduates from Harvard, Princeton, Columbia, Stanford as well as the best universities in Ghana including Ashesi, University of Ghana, Kwame Nkrumah University of Science and Technology as well as the University of Professional Studies Accra. I am proud of my incredible colleagues and what we are achieving together.

We advise on transactions and disputes in areas ranging from corporate and commercial matters of all kinds, banking and finance, property and construction, energy and infrastructure projects and commercial disputes. Our clients are both local and international investors and companies of all sizes,

from startups to Fortune 500 companies. We have advised on landmark transactions such as the development, operation and sale of the Mövenpick Ambassador Hotel by Kingdom Hotel Investments, the development of the iconic One Airport Square, the first green building in Ghana, the development of containerized terminals, power plants, roads, railway projects and the financing of these and other projects. We advise on cutting edge corporate finance and fintech transactions as well as help companies of all sizes with compliance and governance matters. We are committed to helping investors navigate the Ghanaian business environment. We are often called upon to help some of the world’s largest companies to solve some their most complex problems. Alongside our client work, we make the time to do significant pro bono work and have started an initiative called ND&C Launchpad which provides women-owned and led businesses with free or low-cost legal and compliance resources. We love what we do, and we derive a lot of satisfaction from being part of Ghana’s growth and development through our work.

TG: Why is Ghana an interesting proposition for investors?

NAB: Ghana is an incredibly attractive investment destination for many reasons despite the current macroeconomic slowdown and challenges being experienced by the financial sector. We have a stable political environment that is conducive to business growth. Our middle class is growing rapidly, and we are projected to experience significant economic growth in the medium term.

There are several sectors that are particularly interesting to investors right now, one of which is the mining sector. Ghana has a wealth of natural resources, including gold, bauxite, lithium and silica sand. We are also seeing a lot of innovation in the agriculture sector, particularly in the intersection between agriculture and technology. For example, we are currently working with an agtech company that is using a technology platform to help smallholder farmers access international markets, providing them with technical and other services to ensure that they are growing the appropriate crops for which there is demand. There are also significant opportunities for value addition through processing of cocoa, one of the country’s most important commodities,

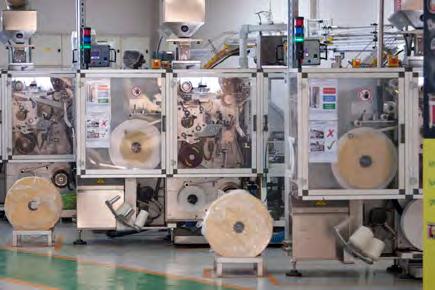

The fintech sector is also incredibly vibrant in Ghana and we have a strong legal and regulatory framework in place to support it, including the regulatory sandbox put in place by the Bank of Ghana. This makes it an attractive sector for investors looking for certainty and stability. The manufacturing sector is also seeing a lot of interest, thanks to the government’s policies. Major brands like VW and Nissan have already opened plants in the country, making it an exciting time for the automotive sector. Overall, Ghana has a robust legal and regulatory framework and offers many opportunities for investors in a wide range of sectors.

TG: Why should investors be encouraged to invest in Ghana?

NAB: Investors should be encouraged to invest in Ghana because Ghana has a robust legal and regulatory framework that is being modernized and enhanced. Recently, numerous new laws have been passed to bring antiquated laws up to date, to fill in regulatory gaps and to provide for future development. For example, in the fintech space, we have clear regulations and in the corporate and commercial space, we have a modern Companies Act that builds on global best practice. There are also plans to enact even more laws to fill in gaps, such as the Limited Partnership Act, which my firm has been advocating for with the Ghana Venture Capital Association. This will make Ghana a more attractive domiciliation jurisdiction for private equity and venture capital funds.

The government is also working to make the implementation of the legal and regulatory framework more efficient and investor-friendly. We have a robust data protection law and a proactive regulator, which is important as we become a more technology-driven society. The Ghana Stock Exchange recently passed guidelines on ESG reporting for public companies, which is a welcome development. ESG and sustainability are important issues that affect us all and it is crucial for local regulators to address them.

Overall, Ghana’s legal and regulatory framework is strong and becoming even more modernized, which should be encouraging for investors. We have a modern public-private partnership law and increasing clarity in public procurement regulation, which is important for infrastructure and other projects. There are laws guaranteeing the unrestricted repatriation of dividends and return of capital and protecting foreign investors from discrimination. Ghana has signed double taxation agreements and bilateral investment treaties with several countries in Africa, Europe and Asia.

TG: What advice do you have for people who are considering investing in Ghana?

NAB: When investing in Ghana, it’s important to have a trusted advisor by your side. Although laws

and regulations are in place and enforced, investors need a local guide to help them navigate the legal and regulatory environment and understand how these operate in practice. Like anywhere else, there are local cultural and business norms that investors must take cognizance of. It’s crucial not to assume that everything will work as it does in their home countries or, conversely, that anything goes in Africa.

There are a few other things that foreign investors should keep top of mind right now. The first thing is local content and participation. Ghana like many African countries, is focused on ensuring that locals participate in all areas of the economy. This policy is formalized in local content and participation regulations, particularly in important sectors of the economy such as energy, telecommunications, mineral mining and natural resources. Even in sectors where there aren’t formal rules, it’s still important for foreign investors to consider how they will engage with local businesses and plan for the impact of future local content and participation laws on their businesses. Because even if it’s not currently impacting their industry, it is coming, so it’s important to be prepared.

Data protection and data privacy issues are also critical issues in Ghana. The country has a robust data privacy law and the Data Protection Commission is becoming increasingly vigilant. Compliance with data protection and privacy laws is essential, even for businesses with just one employee in the country and even those with no presence in Ghana but who process protected data from Ghana. Investors should also consider the impact of EU regulations on ESG on their supply chain as these are increasingly important for businesses globally and locally as the initial IFRS Sustainability Disclosure Standards, S1 and S2, become effective starting January 2024.

It’s important to do due diligence and be mindful of the realities on the ground when doing business in Ghana. Our firm has published numerous articles on doing business in Ghana that are freely accessible on the Insights page of our website www.ndowuona.com. Planning for contingencies and building in extra time is crucial, as doing things the right way can take longer than foreign investors often expect. With the right guidance and preparation, investing in Ghana can be a highly impactful and financially rewarding experience.

Comments