The power sector in Ghana is critical to its development efforts. Over the years, the government has made and facilitated significant investments in the sector with a view to improving access to reliable and affordable electricity for both domestic and industrial use. About 87 per cent of people in the country have access to electricity, including 96 per cent of urban dwellers. The cost of power is, in comparison with other African countries, affordable and supply is also relatively stable and reliable through the year.

There are 27 power producers in the country, with a combined output of 22,051GWh annually, 1,734 of which was exported in 2021. Ghana now has a total installed capacity of 5,134MW, with a dependable capacity of 4,710MW. Thermal power generation accounts for 65 per cent of Ghana’s total power generation, while hydro-power contributes 34 per cent.

There have been recent investments in renewable energy, including a 155MW solar plant being constructed by the UK-based firm Blue Energy, which is expected to boost the country’s electricity generation capacity by 6 per cent.

Africa’s largest solar energy plant, the Nzema project in Ghana’s Western region, was completed in 2016. The government has set itself a target of deriving 10 per cent of power from renewable sources in the medium term. There is great potential for solar energy, as the country receives an average of 4-6 kWh/ m2/day of solar energy and 1,800 to 3,000 hours of sunshine each year, with the northern belt receiving the most.

There are three primary distributors of power in Ghana. The publicly owned Electricity Company of Ghana (ECG) is the main distribution company, serving the Ashanti, Central, Eastern, Greater Accra, Volta, and Western regions, all of which are in the lower third of the country. As at 2021, ECG distributed 90 per cent of all the power available in the country. The other publicly owned distributor, NEDCo, was established to distribute power to the Brong-Ahafo, Northern, Upper East and Upper West regions of Ghana, in fulfillment of the Volta River Authority’s mandate to distribute 161KV to those parts of the country. The third, privately owned distributor, EPC operates exclusively in the Tema Freezone Enclave, supplying about 50 companies located there. Transmission is the sole preserve of Ghana Grid Company, which supplies energy to the three distributors through its network of 68 substations around the country.

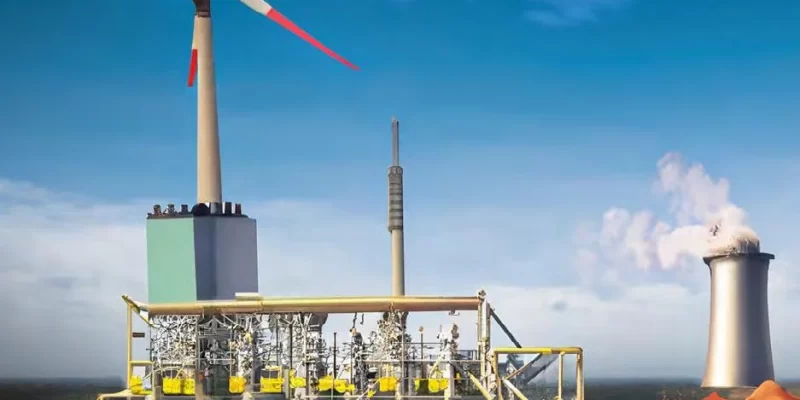

As part of the government’s reforms to attract more private-sector investment and participation in the sector, it passed the Renewable Energy Act (Act 832) in 2011 to kick-start a renewable energy industry in the country. In 2020, NEK Umwelttechnik AG, a Swiss company, built a 1GW wind generation capacity plant in Ghana, comprising the Ayitepa (225MW), Konikablo (200MW), Amlakpo (200MW), Madavunu (200MW), and Koluedor (160MW) wind farms. Further investment in renewable energy has come from the African Development Bank, which in 2021, provided a grant of $27 million for the Ghana Mini-grid and Solar Photovoltaic Net Metering Plan. The project entailed the installation of 67.5MW of capacity, split among 35 mini-grids and several independent solar capacity projects across the Volta Lake region.

Other reforms in the sector include improvements to the supply and distribution systems. With the support of the US, as part of a sixyear, $316 million investment in Ghana’s energy infrastructure, the Kasoa bulk supply point was built and commissioned last year. This followed the inauguration, in 2021, of the Pokuase bulk supply point, also with funding from the US through the Millennium Challenge Corporation. These supply points have supported the reliable distribution of power to hundreds of thousands of schools, hospitals, offices, and homes in Ghana. An off-grid energy distribution network, supported by the Climate Investment Fund, was also completed in 2020 and currently serves 9 districts in the upper middle belt of the country.

Tariffs in the sector are set by the Public Utilities Regulatory Commission (PURC), an independent, multi-sectoral body set up to regulate the provision of utilities such as electricity and water. In setting charges for electricity, the PURC considers charges for generation, transmitting and distributing electricity to the premises of the consumer. It also takes account of statutory levies and charges – value-added tax, the

Leader in electrical installation services

We are an electrical & electronics engineering and contracting company providing our clients with a comprehensive range of services for building projects. We also supply and distribute quality, yet affordable, electrical products.

B. Appah Electricals (BAE) Ltd has experienced steady and continuous growth since it was estab- lished in 1991 by Mr. Ben Appah. We are a highly professional, and very efficient company expanding our success beyond projects in Ghana to other African countries. Our clients know that when they buy from us and/or use our services, the job gets done very well on time and on budget.

National Health Insurance Levy, public lighting, National Electrification Levy, and power factor surcharges – as well as the government’s subsidies including social subsidies to lifeline consumers, subsidies for consumers within the 0-150 units consumption bracket and a special subsidy for selected mining and steel companies.

The sector is under the ambit of the Ministry of Energy, which sets and implements policies, enforces regulations and monitors companies operating in the sector. The Ghana Grid Company, Bui Power Authority, Volta River Authority, Electricity Company of Ghana and the Energy Commission, which oversees licensing and certification in the sector, are all under the direction and control of the ministry.

Sector Opportunities

• Off-grid power solutions to provide cheaper access to rural communities

• Establishment of transmission entities to boost transmission infrastructure which has suffered neglect and underinvestment

• Establishment of distribution entities to complement the three in the sector, only one of which is privately owned

• Investment in large solar projects on a public-private partnerships basis, taking advantage of all year-round sunshine in the country. ■TG

The 2021 Electricity Supply Plan’s projection ran from 2022 through 2026 and tracked an approximately 5.8 per cent compound annual growth rate (CAGR) which increased the peak capacity demand from 3,539MW in 2022 to 4,460MW in 2026. The corresponding projected electricity system energy demand was forecast to grow from 22,799GWh in 2022 to 28,550GWh in 2026. The resulting forecast shows that, by 2030, the system peak demand and energy demand are expected to grow to 5,588MW and 35,772GWh, respectively. From the information gathered from power sector stakeholders, there are seven Renewable Energy projects, of which six are already operational. VRA’s Lawra project is under construction. The seven RE plants are pro – jected to produce a total of 162GWh annually. Of the seven projects, four are owned/hosted by state-owned entities (that is, VRA and BPA) while three (that is, Safisana, BXC, and Meinergy) are privately owned. Safisana also happens to be the only nonsolar project among the seven. Based on the expected performance of the solar projects, it is projected that the Ghanaian system requires over 2,500MW of new solar projects to be implemented by 2030 to reach the RE target/commitment (10 per cent of the Ghanaian electricity system’s annual energy demand or consumption). The seven forecast RE projects generate approximately 162GWh of electricity, leaving an RE generation gap of 3,415GWh, which means the RE penetration is only 0.5 per cent against the target of 10 per cent of total supply.

Source: World Bank http://documents.worldbank.org/curated/ en/099205210162215569/P1759890a9900a07097a304fa323ab3742

Comments