The real estate sector in Ghana has been experiencing significant growth in recent years, owing to economic growth, increased foreign investment and rising demand for housing from a growing local middle class and the Ghanaian diaspora. Ghana has seen a surge in urbanisation, with more people moving to the cities in search of job opportunities and a better quality of life. This trend has driven the demand for affordable housing, particularly in the capital city of Accra, where real estate prices have been rising steadily. Between 2016 and 2021, there was a 30 per cent compounded annual growth in the value of the real estate sector, making it one of the fastest-growing in the country.

The sector is primarily composed of the office, retail, industrial and residential segments. The office real estate market is dominated by private sector players providing facilities to companies in need of work spaces. The current stock of A-grade developments is at about 144,105m2 and there are about 15,000m2 in pipeline developments. There was strong growth before the pandemic, spurred by the government’s incentives for private sector development. Demand for office space is concentrated around Accra, most especially at Ridge, Airport City, and Cantonments and other high-end locations.

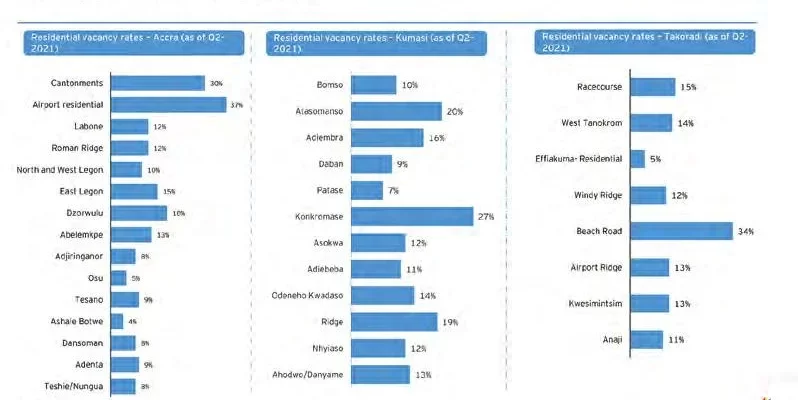

Between 2010 and 2021, the number of residential units in Ghana increased from 3.39 million to 5.86 million, driven by both public and private sector building. However, Ghana still has a steep housing deficit of 1.8 million and the Ministry of Finance estimates that about 60 per cent of Ghana’s urban population requires government assistance to access decent housing facilities.

The retail segment is home to big brands such as Game, Shoprite, Max Mart, Koala, and Melcom, which operate from privately owned malls. There is an estimated 138,000m2 of retail space in the country. Shopping malls house the

majority of retailers but recent trends indicate that there are a growing number of residential developments being converted into retail spaces, while others opt for medium-sized plazas. Footfall in retail centres declined during the pandemic but has rebounded in its wake. Accra Mall, the biggest in the country, attracts an estimated 7 million visitors every year.

The cocoa and energy sector occupy the most space in the industrial seg-

ment, with units predominantly located in Accra, Tema, Kumasi and Takoradi. Government policies which are aimed at spurring industrial growth are the key demand drivers, while supply has been boosted by initiatives such as the One District One Warehouse programme. As at the end of September 2021, 23 warehouses out of the target of 30, each with a storage capacity of 1,000 tonnes, had been completed.

The sector’s growth has been assisted by key developments in the economy, such as the mortgage market which is taking shape. Currently, 9 out of the 23 banks in the country have targeted mortgage products for activities ranging from buying to renovating homes. Another initiative meant to plug the gap in the provision of homes is the National Homeownership Fund, a partnership between the Rent to Own Scheme of the Affordable Real Estate Investment Trust, GCB Capital and three retail banks.

Government is also helping to boost supply by giving land and tax incentives to developers and providing infrastructure to support affordable housing projects. It is also directly building homes, including with its initiative by the Ministry of Works and Housing in collaboration with the State Housing Corporation to provide 6,584 rental housing units at the district level for public workers.

Other policies, such as the Specialised Industrial Zones, are expected to increase the country’s industrial real estate base through partnerships with the private sector. Some completed parks

under the initiative include the Dawa Industrial Park and the Tema Industrial Park by LMI Holdings. The implementation of the African Continental Free Trade Area, which opens up intra-African trade, is expected to boost industrial activity in the country and create increased demand for warehouse space.

The Ministry of Works and Housing exercises oversight over the sector and is responsible for coordinating, monitoring, and evaluating its plans, programmes, and performance. The Architects Registration Council and the Engineering Council regulate the practice and conduct of architects and

engineers respectively, while the Ghana Real Estate Developers Association and the Ghana Real Estate Professionals Association are the trade bodies for real estate developers and professionals.

• Ghana provides tax incentives to real estate companies to carry forward losses incurred in the first three years of operation

• Government is also implementing its digitisation agenda by completely digitising the National Land Registry in Ghana

• Free transferability of capital, profits and dividends

• Ghana is a signatory to the World Bank’s Multilateral Investment Guarantee Agency (MIGA) Convention

• Double Taxation Agreements (DTAs) to rationalise tax obligations of investors in order to prevent double taxation.

SECTOR OPPORTUNITIES

• Construction of residential units, including single units, and apartment buildings at both the affordable and luxury ends of the market to help meet the 1.8 million housing deficit

• Implementation of the AfCFTA will drive demand for retail, service, and industrial space that investors can supply

• Investment in hostel facilities for tertiary institutions around the country, where demand currently outstrips supply

• Locations like Kasoa, Gbawe, Aburi, Peduase, and their environs provide significant land banking opportunities, that will yield significant returns in the medium term

• Development of retail facilities in prime locations like Accra, Madina, Kumasi, Takoradi and other growing urban centres

• Investment in the development of specialised economic zones, industrial parks and warehousing facilities to drive the government’s One District One Factory plan. ■TG

Comments